Let's assume for a minute that the odds are against you when trying to time the market. The costs to transact and the likelihood that you would mis-time your movements are simply too high. There is substantial empirical evidence to suggest that this is the case. Your best remaining option is to try and devise an investment strategy that relies upon continuous investment over long periods of time. You should allocate your portfolio in a meaningful way with a deep understanding of the potential downside risks involved, having looked at the worst periods available for your allocation. The last month and year could serve as a good proxy.

Thanks to the Capital Asset Pricing Model (CAPM) provided by economist and Nobel Laureate William Sharpe, we know that the most effective way to reduce a portfolio's overall risk while not substantially effecting the expected return is through diversification. In this sense, diversification does not mean holding 30 stocks as opposed to 10....it's more like holding 17,000.

There are two broad categories of risks associated with investing in stocks. Unsystematic risk, which are risks such as a company fails or all the companies in a particular industry sector suffer for one reason or another. The good thing is unsystematic risk can virtually be eliminated through proper diversification. The other broad risk is the systematic risk of the market as a whole. Systematic risk includes macroeconomic conditions affecting all companies in the stock market and cannot be diversified away. Today's credit crisis is an excellent example.

Investors can expect long-run compensation in the form of a risk premium for accepting systematic risk. The same can not be said for investors who accept risks that can ultimately be diversified away.

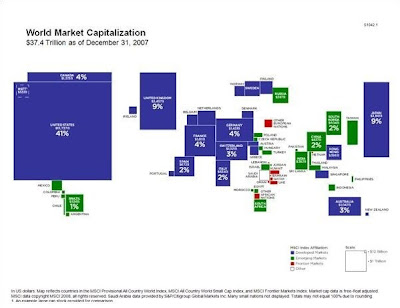

Below is a cartogram representing the market capitalization, as of the end of 2007, of each country's stock market relative to the world's total market value:

A well diversified portfolio would have some exposure to each of these markets. As it's impossible to predict which of these markets is likely to perform well in any given time period, one would benefit from investing in all available. The stock portion of our portfolios usually contain 60% U.S. stocks, 30% Developed Nation non-U.S. stocks and 10% Developing Nation non-U.S. stocks. This stock portion may be as little as 20% or as high 80% of the overall portfolio, depending on the risk tolerance and needs of the investor.

Regardless, each of our portfolios has some exposure to stocks, but that exposure is as diversified as possible, leaving only the systematic risk of the market behind.

No comments:

Post a Comment